In this guide, we’ll explain how and when to register for Self Assessment, and how the registration process might vary depending on your circumstances.

You must register for Self Assessment with HMRC if you have to send a tax return and you did not send one last year.

You’re likely to have to submit a tax return if, in the last tax year (6th April 2022 to 5th April 2023), any of the following applied to you:

If you’re in any doubt about whether or not you need to send a tax return, you should check with an accountant who will be able to advise you.

Further reading: If you’re unsure about whether or not you have to register for Self Assessment, our dedicated guide contains more information about who has to send a tax return. If you earned income from property, you can also find more information in our guide to tax for landlords.

The deadline for registering for Self Assessment is the 5th October that follows the end of the tax year that the Self Assessment tax return you’re filing relates to.

For example, if the tax return relates to the tax year starting 6th April 2023 and ending 5th April 2024, you should register for Self Assessment by 5th October 2024. You can still register after the deadline, but you could be fined.

If you registered for Self Assessment and filed a tax return last year, you don’t need to re-register in order to submit this year’s return.

Further reading: You can find out more about the different Self Assessment deadlines in our dedicated guide.

The process for registering for Self Assessment and filing a tax return can vary depending on your circumstances:

If you already have a business tax account with HMRC, you can register by signing in to this account and adding Self Assessment to your list of services. You’ll need a Government Gateway user ID and password in order to sign in to your business tax account.

If you don’t have a business tax account or a Government Gateway user ID, select ‘Create sign in details’ link on the login page and follow the instructions.

You should receive a letter from HMRC with your Unique Taxpayer Reference (UTR) number within 10 working days (21 days if you live abroad). You should also receive a separate letter within seven working days with an activation code for your business tax account. You can retrieve a lost UTR number or get a new activation code from HMRC if you lose either of them after they arrive.

Once you’ve received your UTR number and activation code, you can log in to, and activate, your business tax account. Once you’ve done this, you should be able to add Self Assessment to your list of services and file your tax return.

Further reading: HMRC provides more information about how to register if you're self-employed on its website.

Those who are not self-employed and are required to register for Self Assessment need to do so using form SA1. You can complete the form online (you’ll need an account with HMRC to log in) or print it out and post it to HMRC. If you’re a landlord, you can also use form SA1 to register for Self Assessment.

Even if you print and post your form, you will still need to create an online account with HMRC in order to register. Once you’ve done this, you should then receive a letter from HMRC within seven working days (21 days if you live abroad) with an activation code for your account. You can use this to log in and activate your online account.

Once you’ve submitted form SA1, you should receive a letter with your Unique Taxpayer Reference (UTR) number within 10 working days (21 days if you live abroad). You can retrieve a lost UTR number from HMRC if you lose it after it arrives.

Once you’ve activated your account, you should be able to log in, add Self Assessment to your list of services and file your tax return (you’ll need your UTR number in order to do this).

Further reading: HMRC provides more information about how to register if you’re not self-employed on its website.

Partners in partnerships are required to register for Self Assessment using form SA401. HMRC provides more information about how to do this on its website.

You’ll need your partnership’s UTR number in order to complete form SA401. You can retrieve this number from HMRC if you’ve lost it.

You can complete form SA401 online or print it out and post it to HMRC.

If you’re the ‘nominated partner’ of the partnership, remember that you are also responsible for registering your partnership for Self Assessment (in addition to registering yourself as an individual).

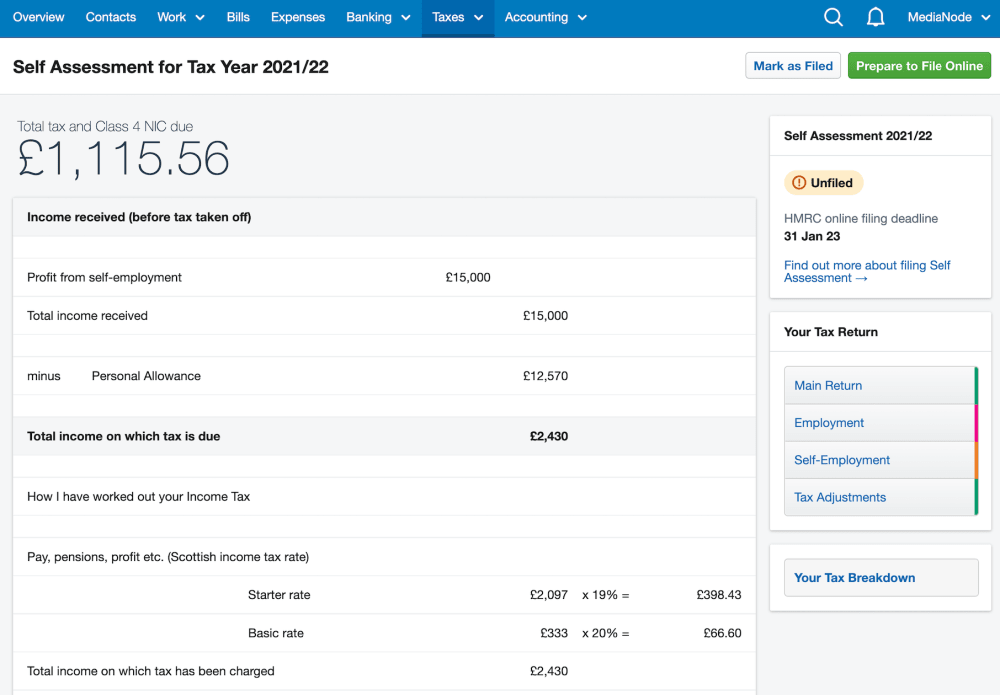

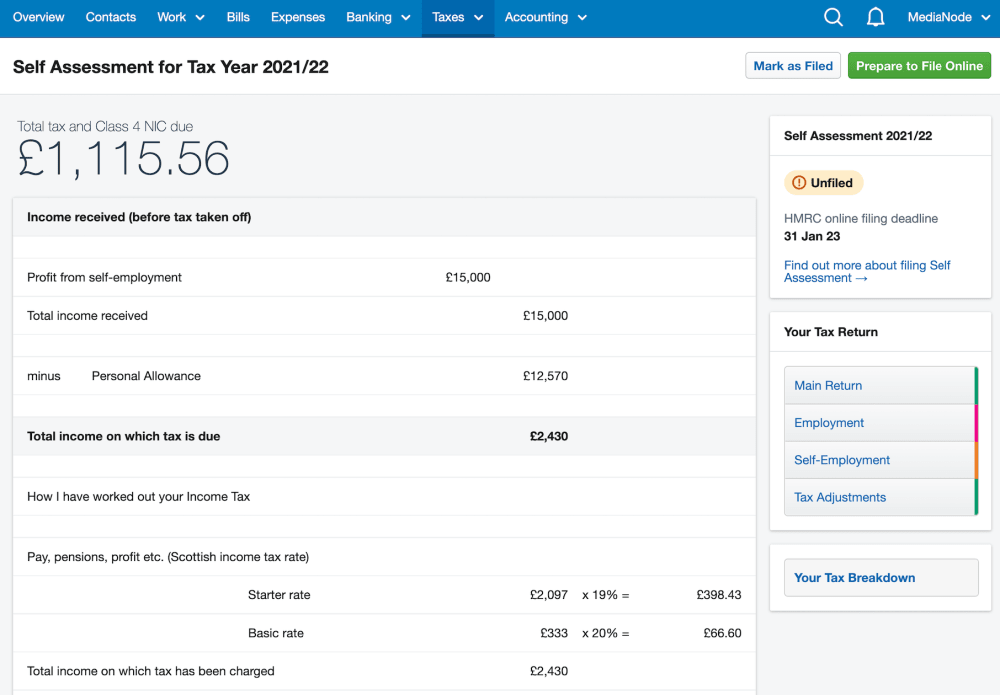

If you’re a sole trader or limited company director, FreeAgent works away to calculate your Self Assessment liability and prepare your tax return in the background as you go about your daily business.

FreeAgent also provides you with a clear overview of your tax position and helps you see all your liabilities build up over time, so you’ll know what you owe and when. Take a closer look at how FreeAgent can help with Self Assessment in FreeAgent and start your 30-day free trial today.

Disclaimer: The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.

Award-winning accounting software trusted by over 150,000 small businesses and freelancers.

FreeAgent makes it easy to manage your daily bookkeeping, get a complete view of your business finances and relax about tax.

Simplify your bookkeeping and join over 150,000 freelancers and small businesses: